October 15, 2013 | News | New Publication

The poor die younger

The disparities between the social classes is growing

People who had earned a good living during their working years and who are receiving a large pension have a higher life expectancy. © steffne / photocase.com

(The following text is based on the original article ""Widening socioeconomic differences in mortality among men aged 65 years and older in Germany"" by MPIDR researchers Domantas Jasilionis and Vladimir Shkolnikov has also been published in the issue 03/2013 of the demographic quarterly Demografische Forschung aus Erster Hand.)

Life expectancy in Germany has been rising for years. While all citizens can potentially benefit from this increase, they will not benefit equally: in 2008, 65-year-olds with the highest incomes could expect to live another 20 years, while 65-year-olds with the smallest pensions could expect to enjoy less than 15 years of additional life.

Does this mean the divide between the poor and the rich is increasing? Is life expectancy among the lower social classes actually sinking? These are questions that are frequently asked, and for which there are no simple answers. In a study published by the Max Planck Institute for Demographic Research in Rostock (MPIDR), researchers analyzed comprehensive data from the German Pension Insurance, which covered 86% of the male population. Vladimir Shkolnikov and Domantas Jasilionis of the MPIDR, together with Eva Kibele of the Centre for Population Research at the University of Groningen, showed in the study that average life expectancy is increasing among men of all social classes, but that it is rising much more slowly among men with very small pensions than among their better situated counterparts.

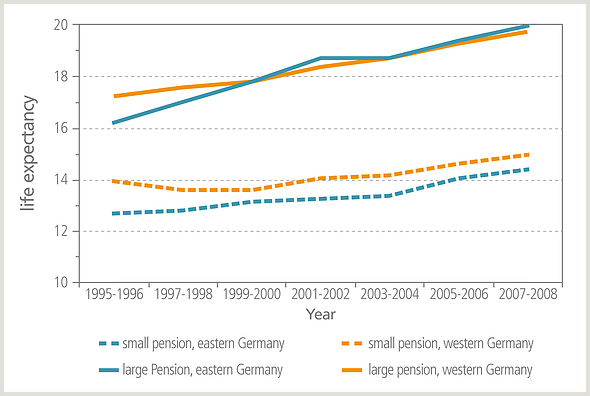

Fig. 1: Remaining life expectancy at age 65 according to income group in years: a retiree who is receiving a large pension (more than 65 pension points) can expect to enjoy it for longer than a retiree who is drawing a very small pension (30 to 39 pension points). Sources: own calculations, the Research Data Centre of the German Pension Insurance (FDZ-RV).

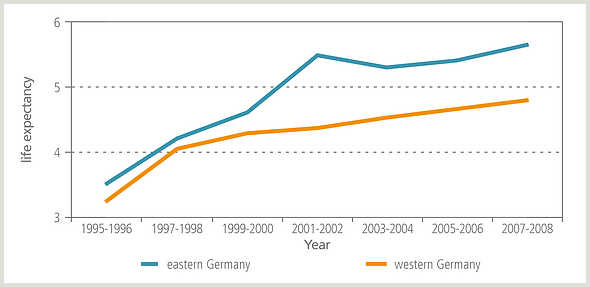

In the mid-1990s, men aged 65 in western Germany who had earned a good living during their working years and who were receiving a large pension could expect to live three years—or 3.5 years in eastern Germany—longer than their counterparts who were drawing a small pension. And these already large differences have actually increased in recent years: by 2008 this gap between these two groups of male pensioners had risen more than one and one-half years to 4.8 years in western Germany, and by more than two years to 5.6 years in eastern Germany (see Fig. 1 and 2). This means that in 2008 a 65-year-old man with a small pension could expect to live to age 79.8, while a man of the same age with a generous pension could expect to live to age 84.3.

Women were not included in the analysis because their income is harder to determine. At least in western Germany, many women are supported not only by their own earnings, but also in part by the wages and pensions of their husbands. Men who were foreigners or who had a migration background were also excluded as their earnings histories are often incomplete.

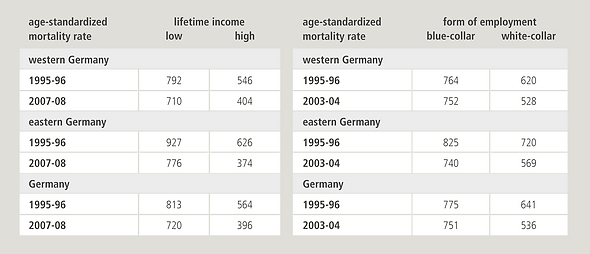

The remaining pensioners were categorized according to the pension points they had collected over the course of their working lives (see glossary). From the six resulting income groups, they selected the group with the smallest pensions (30 to 39 pension points) and the group with the largest pensions (more than 65 pension points) for their comparison. They also compared blue-collar and white-collar workers. In order to compare the mortality of these four groups, the researchers used two additional units of measurement: they looked at how high the annual mortality rate was for each group (see Tab. 1), and they calculated the remaining life expectancy of the 65-year-olds (see Fig. 1).

Fig. 2: The gap in life expectancy between the poor and the rich has grown in recent years. The graph shows how many additional years a 65-year-old with a higher lifetime income can expect to live than a retiree with a very small pension. Sources: own calculations, the Research Data Centre of the German Pension Insurance (FDZ-RV).

The results were clear: in all of the periods studied, the pensioners with the low incomes had the highest mortality, and the pensioners with the high incomes had the lowest mortality. Over time, the differences in mortality rates and life expectancy among 65-year-olds became even greater. The results showed that starting in the mid-1990s in particular, life expectancy has grown relatively slowly among men with the smallest pensions. Within just a few years of the starting point, the wealthy pensioners had gained several months of additional life expectancy relative to their poorer counterparts. By around the year 2000 this trend had slowed somewhat in western Germany, but it continued to accelerate among high-income men in eastern Germany until 2002. Despite the east-west differential, the mortality of high-income eastern German 65-year-old men was actually lower than that of high-income western Germans of the same age. The authors concluded that men in this former group benefited significantly from the enormous increase in life expectancy in eastern Germany after unification, and from the sharp contraction in the east-west differential.

After 2003, however, the disparities between the social groups did not continue to grow quite as rapidly. But as before, in both eastern and western Germany, the high-income pensioners continued to benefit from the increases in life expectancy to a greater extent than the low-income pensioners

The differences between blue- and white-collar workers were found to be smaller than the gaps between the income groups (see Tab. 1). They also rose from the mid-1990s onwards, but then stabilized or even decreased. However, the distinction between the different classes of workers is rather vague, as it does not sufficiently reflect the lines between the various social classes and hierarchies found in the workplace. The fact that the study was nonetheless able to show relatively large differences between the two income groups confirms the main result of the study: low earners benefit less from increases in life expectancy than high earners.

Tab. 1: The table shows how high the mortality rate (per 100,000 people) is in each of the income and occupational groups. Sources: own calculations, the Research Data Centre of the German Pension Insurance (FDZ-RV).

Because certain groups were excluded—i.e., foreigners, civil servants, the self-employed, and men who earned less than 30 pension points over their working lives—the data used in the analysis were incomplete. The demographers emphasized, however, that because these groups are relatively small, their exclusion should not affect the validity of the results. Moreover, the German Pension Insurance data are the only available data in Germany that allow researchers to capture both socioeconomic status and mortality. The analysis of these data therefore provides the only reliable answers to our opening questions regarding the relationship between life expectancy and social status.

Glossary: Categorization according to pension points

The number of pension points is calculated based on the ratio between an individual’s personal income and the average income for the year. Those who have incomes above the average earn more than one pension point per year, while those who have incomes below the average earn less than one pension point per year. The number of pension points an individual man is credited with depends on whether his income was above or below the average and how many years he worked. Men who earned less than 30 points over the course of their working lives were excluded from the analysis. While this group would indeed include men who had earned very little, it would also include men who had other sources of income, such as from investments or from self-employment. Thus, the heterogeneity of this group would have greatly distorted the results.