June 25, 2025 | News | SPOTLIGHT

Should you Claim Your Pension Early or Wait?

[SPOTLIGHT]

USA: the role of lifespan uncertainty and income inequality

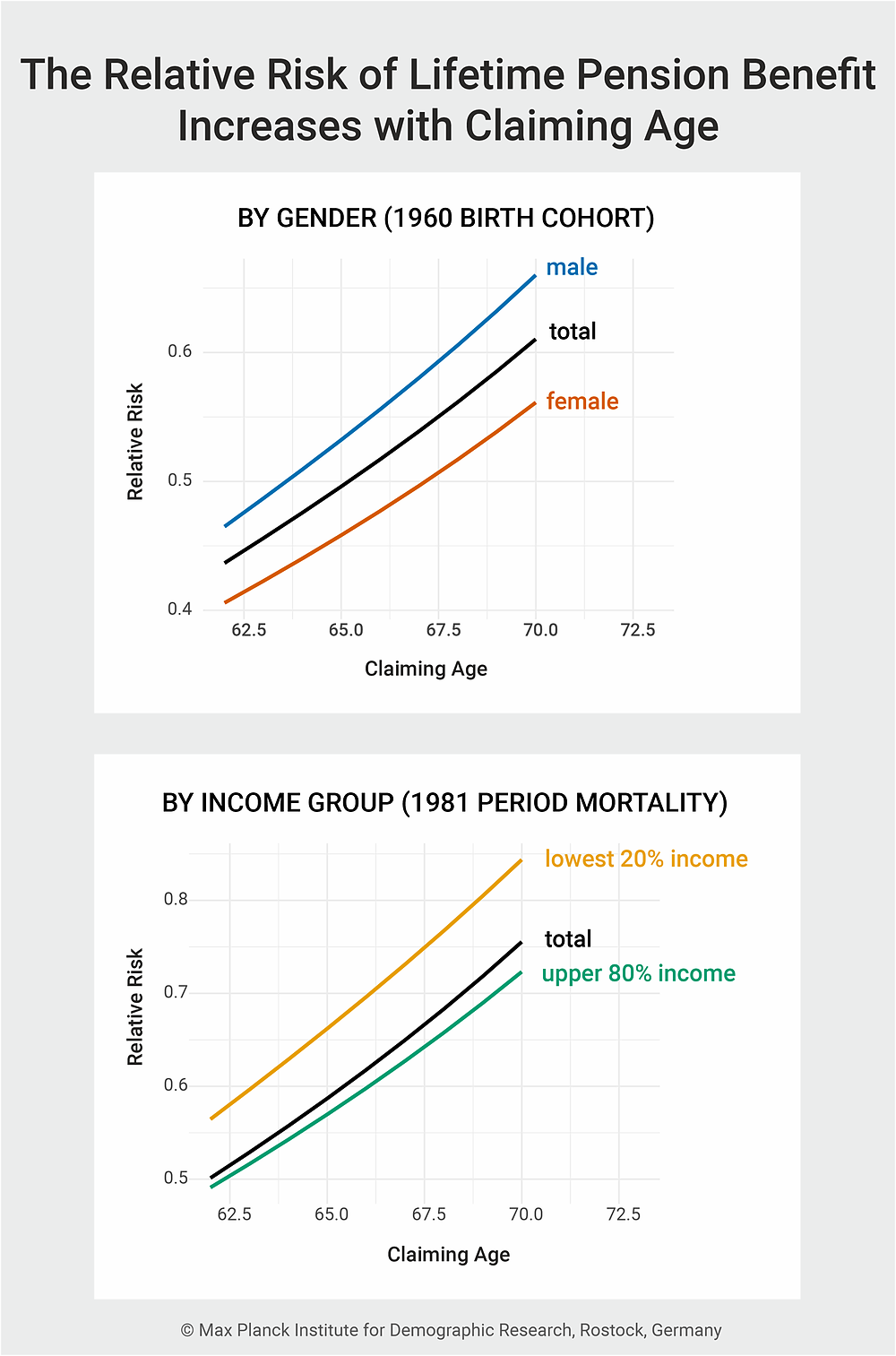

In the US, the later you retire, the higher your monthly pension benefit will be. Researchers have investigated whether this is optimal, given the uncertainties surrounding life expectancy. The results show that delaying retirement poses a particular financial risk to men and low-income groups, and that different decisions are necessary depending on individual circumstances and uncertainty.

In the US, people who claim their pension later receive a higher amount. However, researchers have investigated whether this is beneficial, given the uncertainties surrounding life expectancy. © iStockphoto.com / skynesher

In the US, the later you retire, the higher your pension will be. But is it really worth waiting longer? Researchers at the Max Planck Institute for Demographic Research (MPIDR), Stanford University and Huazhong University of Science and Technology (Wuhan) investigated this question. They examined how uncertainty about one's life span affects the optimal age for receiving social benefits. Their result shows that claiming benefits at 62 (the earliest possible age) can be a rational response to lifespan uncertainty, which provides a new perspective on why many Americans do so in practice.

'Life expectancy is uncertain, even for well-informed people. We demonstrate that this unavoidable demographic risk escalates when claiming social security benefits is delayed, particularly affecting men and low-income groups. Early claiming, often viewed as suboptimal, can be a rational response to unavoidable uncertainty,” explains Sha Jiang, author of the study and researcher in the Research Group Kinship Inequalities and in the Laboratory for Digital and Computational Demography at MPIDR.

Retire at 62 – a rational decision

Jiang and her colleagues have constructed an actuarially fair social security model in which total lifetime benefits are on average identical regardless of the timing of claims. 'We created a simplified model that captures the essential, actuarially fair features of the US social security system. To isolate the effect of life expectancy uncertainty, we focused on two risks: dying before claiming benefits or living only a short time after claiming them. The result is clear: delaying increases the financial risk, especially for men and people with lower incomes," said Jiang.

In the US, approximately 50 per cent of the population claim social security at the earliest possible age, i.e. 62. 'Some experts consider this irrational. However, our model comes to a different conclusion. For people with limited savings or uncertain health, claiming early can help reduce risk. This way, they receive at least some benefits, even if they do not live long. Others may opt for a middle ground, claiming benefits a few years later to receive higher monthly benefits, thereby balancing risk and return. The key is how much uncertainty you can afford," explains the researcher.

Claiming a pension later in life increases financial risk, particularly for men or those on lower incomes.

One solution does not fit all

Many retirement planning tools and concepts are based on the idea that people can plan based on average life expectancy. 'However, our research shows that average forecasts can be dangerously misleading.' This inherent uncertainty of lifespan must be taken into account by policymakers if they want to make fair and effective decisions about retirement provision. Promoting later retirement without tailoring it to individual circumstances could exacerbate existing inequalities in retirement outcomes.

'For millions of Americans, especially those in poorer health or with lower incomes, early withdrawal of benefits is not a miscalculation, but a rational response to risk. This understanding can help to develop fairer and more realistic policies for an ageing society,' says Sha Jiang.

Original Publication

Jiang, S.; Zuo, W.; Guo, Z.; Tuljapurkar, S.:

Genus 81:5, 1–27. (2025)

Keywords

Social Security; lifespan uncertainty; claiming age; lifetime pension benefit