September 21, 2022 | Press Release

Swedish Pensions: Large Gap in Lifetime Pension due to Lifespan Inequality

© iStockphoto.com/FJZEA

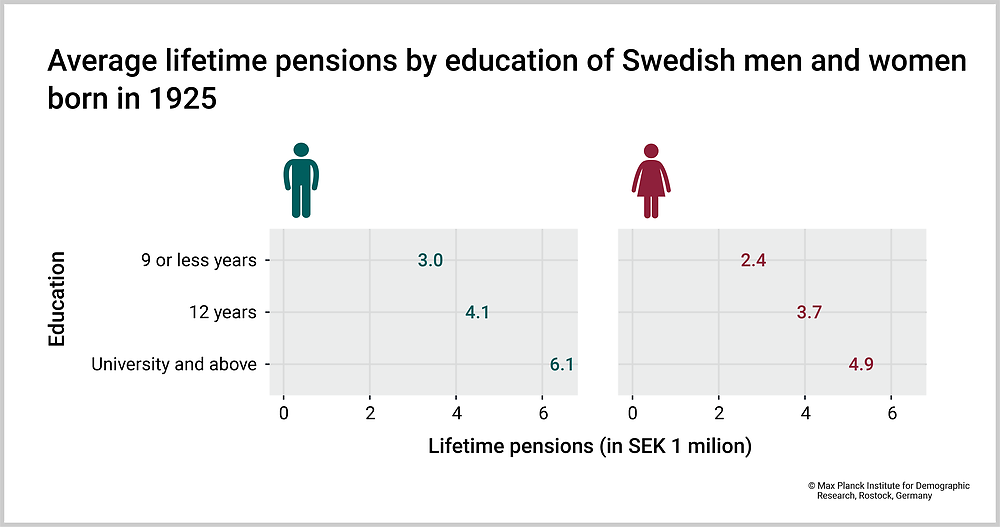

The better educated and richer you are the longer you live. The longer you live, the more pension income you receive over your lifetime. For the first time, Jiaxin Shi, a PhD Student at the MPIDR calculated the total differences in lifetime pensions related to education and earnings in Sweden. He found the discrepancy between lifetime pensions between men born in 1925 with nine or less years of education and men with university level education was approximately 3 million SEK (about 375,000 USD). Nearly one quarter of this difference was because those with better education lived longer, with differences in income accounting for most of total pension income.

To understand how pension systems actually distribute money it is important to examine lifetime pensions. Jiaxin Shi, PhD Student at the Max Planck Institute for Demographic Research (MPIDR) in Rostock, Germany as well as the University of Oxford and his colleague Martin Kolk from Stockholm University assessed the roles of longevity, prior earnings, and pension design to determine socioeconomic differences in lifetime pensions.

Politicians creating pension systems often aim to make the pension system progressive. That means that those with lower income receive a higher percentage of their prior earnings in pension income than those with higher income. But differences in how long you live between well-educated people with higher income and low-educated people with lower income makes the pension system fall short of that goal. Individuals who are less educated and earn less tend to live shorter lives and thus have fewer years of pension income.

For the case of Sweden, Jiaxin Shi and Martin Kolk found substantial gaps in lifetime pension income between education and earnings groups. Similarly, to the different levels of lifetime pension for men of different education levels, they also found differences between women with only primary or university level education.

© MPIDR

Download Figure (PNG File, 174 kB)

The researchers also found large differences by gender. Men had higher average lifetime pensions than women but a shorter life expectancy. In other words, women had an advantage because of their longer lifespans, but a disadvantage in that a lower annual pension income more than offset the longevity component and led to an overall male advantage in lifetime pensions.

Up to one quarter of the inequality in lifetime pensions is attributable to the fact that socially advantaged groups live longer—this is particularly true for men. Longevity inequalities play an important role but less so than inequalities in prior earnings.

“The pension system in Sweden is less progressive than we thought”

The researchers used five decades of Swedish taxation data, linked to the birth register from 1925 and death registers from 1970 to 2018, covering the entire Swedish population. Their paper was recently published in the journal Demography.

“We found that the pension system in Sweden is less progressive than we thought because of the regressive role of mortality. Those with lower income need to receive an even higher percentage of their prior earnings in pension income to compensate for the effect of longevity differences between socioeconomic groups,” says Jiaxin Shi.

The results for Sweden may not be transferable to other countries because not only pension systems, but also the levels of longevity inequality and earnings inequality, differ across countries.

Original Publication

Shi, J., Kolk, M.: How Does mortality contribute to lifetime pension inequality? Evidence from five decades of Swedish taxation data. Demography (2022). DOI: 10.1215/00703370-10218779

Authors and Affiliations

Jiaxin Shi, Max Planck Institute for Demographic Research, Rostock; Oxford University's Leverhulme Centre for Demographic Science; Stockholm University

Martin Kolk, Stockholm University; Institute for Future Studies, Stockholm; Åbo Akademi University, Vaasa